The Ins and Outs of Loaning From Hard Money Lenders

From comprehending the basics of how difficult money lending institutions run to evaluating the pros and disadvantages of such loans, there are different aspects to check out prior to involving in this borrowing method. Prior to diving rashly into the complexities of difficult money lending, possible debtors must grasp the qualifications required, the terms connected to these fundings, and effective approaches for protecting effective transactions.

The Basics of Hard Money Lenders

Tough cash loan providers, often referred to as personal lenders, give short-term finances secured by realty collateral. These loan providers usually concentrate on the worth of the building being utilized as security instead of the debtor's credit report. Customers seeking quick funding or those who may not certify for conventional small business loan often transform to difficult cash loan providers because of their fast authorization process and flexibility in terms. Interest rates from tough money loan providers are higher than conventional financings, showing the increased danger they take by lending to customers who might not fulfill conventional loaning criteria.

When collaborating with tough money lending institutions, borrowers need to be planned for shorter car loan terms, typically varying from 6 months to a couple of years. Furthermore, tough cash lenders might call for lower loan-to-value ratios compared to traditional lenders, meaning borrowers might require to offer a bigger down repayment. Comprehending the essentials of hard cash borrowing is critical for consumers to make informed decisions and successfully browse the loaning procedure.

Benefits And Drawbacks of Difficult Money Financings

When evaluating tough cash loans, consumers need to thoroughly evaluate the benefits and negative aspects of this alternative financing choice. Standard financings frequently entail a prolonged authorization process, whereas tough cash loan providers focus more on the value of the residential or commercial property securing the car loan, allowing for quicker approval and funding.

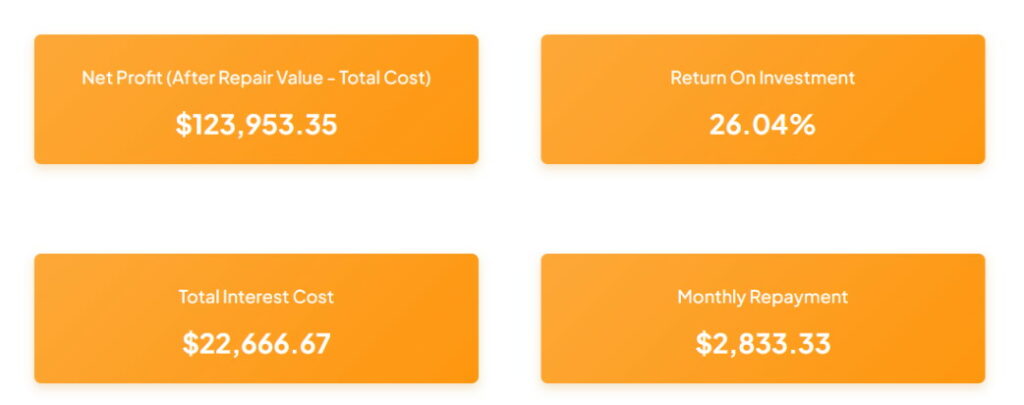

Nevertheless, there are also noteworthy drawbacks to think about. Tough cash finances typically include higher rate of interest than conventional financings, which can dramatically enhance the cost of borrowing. Furthermore, the loan-to-value ratios for difficult cash loans are generally lower, suggesting consumers might need to find up with a larger deposit (hard money lenders atlanta ga). The much shorter car loan terms connected with hard cash fundings can result in greater monthly repayments, which may be challenging for some debtors to manage.

Certifications for Hard Money Borrowers

Provided the one-of-a-kind attributes and considerations related to difficult cash lendings, prospective debtors should satisfy details qualifications to secure financing from these different lenders. Hard money lenders usually focus on the worth of the home being utilized as security instead than the borrower's credit report or financial background. Therefore, one of the key credentials for tough money customers is having a building with considerable equity to Learn More install as protection for the car loan.

Along with property equity, tough money lending institutions may also take into consideration the borrower's exit technique. This refers to exactly how the consumer intends to pay back the car loan, typically through the sale of the building or refinancing with a conventional mortgage. Showing a feasible exit strategy is crucial for protecting funding from difficult money loan providers.

Furthermore, consumers may require to give documentation such as property evaluations, evidence of earnings, and a solid organization plan if the loan is for a genuine estate investment. Meeting these credentials can raise the chance of authorization and effective financing from difficult money lenders.

Recognizing Tough Cash Car Loan Terms

Hard cash finance terms commonly differ from standard bank financings in numerous key aspects. Furthermore, tough money loans typically come with higher interest rates contrasted to traditional loans. Tough cash car loans may include points, which are upfront costs computed as a portion of the total financing quantity - hard money lenders atlanta ga.

Tips for Effective Loaning

For successful loaning from hard money lending institutions, debtors need to prioritize comprehensive study and due diligence to protect the very best terms for their monetary demands. Begin by investigating reliable tough money lenders that have a performance history of reasonable techniques and clear dealings. Try to find loan providers who specialize in the type of car loan you need, whether it's for real estate investments, company financing, or one more function. Recognizing the particular terms of the financing is vital, so customers must meticulously evaluate the rate of interest, charges, payment timetable, and potential fines for late repayments.

When approaching tough money lenders, be prepared to make a strong instance for why you are a reputable consumer. By following these ideas, debtors can increase their possibilities of securing an effective lending from hard cash loan providers.

Verdict

To conclude, understanding the essentials of hard money loan providers, weighing the pros and disadvantages of hard money lendings, satisfying the certifications required for loaning, and understanding the regards to tough cash car loans are important for effective borrowing. By following these guidelines and suggestions, customers can browse the process of borrowing from difficult cash loan providers efficiently and make notified choices that align with their financial objectives.

Traditional fundings frequently involve a lengthy approval procedure, whereas tough cash lending institutions focus extra on the worth of the home protecting the learn the facts here now lending, allowing discover this info here for quicker approval and financing. Difficult cash loans generally come with greater rate of interest rates than traditional lendings, which can significantly enhance the price of loaning. The much shorter funding terms associated with tough money financings can result in greater month-to-month payments, which may be challenging for some borrowers to handle.

:max_bytes(150000):strip_icc()/what-happens-if-you-dont-pay-a-collection-960591-v3-5bbe02b546e0fb00510fde7e.png)

:max_bytes(150000):strip_icc()/buying-subject-to-an-existing-loan-1798423-27ea8f47081b44c7b2ba85a2326595e2.jpg)